Talk:Peak oil/Archive 4

| This is an archive of past discussions about Peak oil. Do not edit the contents of this page. If you wish to start a new discussion or revive an old one, please do so on the current talk page. |

| Archive 1 | Archive 2 | Archive 3 | Archive 4 | Archive 5 | Archive 6 | → | Archive 8 |

Please blockquote when quoting large amounts of text

The above discussion is hard to follow, because the large amounts of quoted text intermingle with the later comments, making it hard to understand who is making what point, and in response to what. When quoting large amounts of article text, please place it inside blockquote or div tags with a background color to distinguish it from the fresh text that you are typing, like this:

Here is some blockquoted text.

Then it will be easier for others to read the discussion and formulate opinions about it. --Teratornis (talk) 16:25, 7 April 2008 (UTC)

References

I meticulously spent a lot of time creating references in the Harvard style. Many new references have been added in the old form and don't show up on the reflist properly. This needs to be corrected. Can someone step up to the plate and work on this please? Kgrr (talk) 23:05, 31 March 2008 (UTC)

What I am expecting here is to follow this reference style:

<ref>{{cite journal | quotes = | author = last, first | date = 2008-03-31 | year = | month = | title = A sample article title | journal = A sample journal title | volume = 1 | issue = 2 | pages = pp. 1092-1095 | publisher = Big Publishing House | location = New York | issn = 1234578432 | pmid = | doi = 10.4320432 | bibcode = | oclc = | id = | url = http://www.journal.com/issue1232341234.html | language = English | format = | accessdate = 2008-04-01 | laysummary = | laysource = | laydate = | quote = }}</ref>

<ref>{{cite web |url= http://www.publisher.com/123432.htm |title= This is the title |accessdate= 2008-04-01 |accessdaymonth= |accessmonthday= |accessyear= |author= Last, First |last= |first= |authorlink= |coauthors= |date= 2008-01-1 |year= |month= |format= |work= |publisher= Name of the publisher |pages= |language= English |doi= |archiveurl= |archivedate= |quote= }}</ref>

Kgrr (talk) 00:20, 1 April 2008 (UTC)

- If you were attempting to format your examples like this:

<ref>{{cite journal | quotes = | author = last, first | date = 2008-03-31 | year = | month = | title = A sample article title | journal = A sample journal title | volume = 1 | issue = 2 | pages = pp. 1092-1095 | publisher = Big Publishing House | location = New York | issn = 1234578432 | pmid = | doi = 10.4320432 | bibcode = | oclc = | id = | url = http://www.journal.com/issue1232341234.html | language = English | format = | accessdate = 2008-04-01 | laysummary = | laysource = | laydate = | quote = }}</ref>

- the way to make that happen is to indent the first line of the example by one space. See Help:Wikitext examples#Just show what I typed. Also, the three basic help/guideline pages for footnotes are: WP:CITE, WP:CITET, and WP:FOOT. Everybody who adds a reference to an article should read those pages. --Teratornis (talk) 00:39, 19 April 2008 (UTC)

- Also see WP:EIW#Citetools for some tools to make citations like the above much easier to generate. I installed WPCITE, and it's great. --Teratornis (talk) 05:48, 9 May 2008 (UTC)

Meaningless Contextless statistics

While I perceive this to be an excellent article, and would like to praise all contributors, a couple of incompletely stated statistics seem to render them meaningless: e.g.- “World demand for oil is set to increase 37% by 2030” – What does this mean… from what base year, date or value, is it from 1880 a.d. or date of writing the article (if so, what year was it written) or current day. “World crude oil demand has grown at around 2 percent in recent years” – What does that mean… Is the 2% growth per annum?, per quarter?, over a five year period? “Demand will hit 118 million barrels per day (188,000 m³/d) from today's existing 86 million barrels” When was today?... or is this statistic updated on a daily basis?

I’m not sure if this is isolated to this paragraph, but I will check through the rest when I can. Otherwise, excellent work —Preceding unsigned comment added by Wiremu 67 (talk • contribs) 03:09, 7 April 2008 (UTC)

- Luckily all the answers were in the sources. I took a few minutes and sorted it out. NJGW (talk) 14:45, 7 April 2008 (UTC)

- The relevant guideline is WP:DATED. When the sources do not define the dates, we can resort to marking sections with the {{uncleardate}} template. This problem is common because many of our sources are news articles with expressions that date quickly ("In recent months", "Over the next 30 years", etc.). Wikipedia editors must learn to nail down the dates as they rewrite source material into encyclopedic form. This is, by the way, one reason why Wikipedia is growing in popularity. A Wikipedia article is often better than a search of the wider Web on a topic because the Web is full of pages with unclear dates. Lots of people write news articles that make sense when they are new, but years later the articles are still online, and the reader has to figure out when an article appeared and then mentally translate all the dated material. --Teratornis (talk) 17:03, 7 April 2008 (UTC)

Graphs

How about a chart showing past and projected production/consumption and discovery on the same graph? Richard001 (talk) 08:13, 20 April 2008 (UTC)

- You're possibly thinking of a chart like the one that appears 1 min 26 sec into the following video, under the caption "It's Simple Really":

- I agree that would be an excellent chart, and it could also superimpose the price of oil. So will you create it? --Teratornis (talk) 05:53, 9 May 2008 (UTC)

- I second the motion. A chart showing past and projected production/consumption and discovery on the same graph would be a good addition. I can help put it together. Kgrr (talk) 14:21, 11 July 2008 (UTC)

Energy Non-Crisis

Has anyone checked this guy out? Does anyone know if he's a fringe madman or if there's any legitimacy? It may warrant inclusion if under nothing else than, "Conspiracy Theory".--Loodog (talk) 03:13, 11 May 2008 (UTC)

- Yeah, someone added it as a link two weeks ago. At first I edited the attribution, but after I watched the video and looked up some of his background information I took it out. First, it's all hearsay from a non-oil person, so major grain of salt. But even more damning is the fact that his whole underlying theory of why the US won't release the decades of oil that is supposedly hidden under Alaska's north shore is the middle east owns all our national debt, so we have to keep them happy. Actually that's totally false[1]. In fact, the US owns half it's own debt (not really sure how that works), followed by Japan, China, the UK, Brazil, and THEN "oil exporters" (even though they seem to have gone on a buying spree the last 9-12 months, and even so own about 1/4 what either Japan or China own). Third, he claims this gives them some sort of domain over us, when in fact it just means they have major interest in the dollar staying strong (so their investment stays valuable). In fact, even if they owned all our debt, all we would have to do is print more money to buy it back!

- No, Mr. Williams is proud to tell you he's good friends with the fringe captain, Dr. Stanley Monteith[2] (who believes in very fast abiogenesis of oil, and that a global cabal of some sort controls each and every government, and there isn't a head of state in the world who isn't a low level pawn in their game). But boy doesn't he spin a good yarn? Gets you gripping your seat for the whole 75 minutes, just waiting for him to actually say something that ties it all together... something you could actually check up on! Of course he HAS to wait 'til the very end to drop the bomb, because if you actually bother looking it up everything he said before it just unravels... NJGW (talk) 04:37, 11 May 2008 (UTC)

- What "the US owns half its own debt" means is that large numbers of Americans have obligated their children to pay debt service in the form of taxes to the children of the tiny minority of Americans who have enough wealth to hold significant amounts in treasury bonds. Wealth in the U.S. follows a Pareto distribution, which means the top 1% of U.S. citizens by wealth hold a huge fraction of the total wealth. They lend lots of it to the U.S. government, so the majority of U.S. taxpayers may consume a greater value in public goods than they pay for with their taxes. In return, these taxpayers agree to obligate future taxpayers to pay service on the debt. Since lots of that debt will remain outstanding for decades, effectively that means middle and low-income taxpayers are selling their children into a kind of indentured servitude to whoever inherits all those T-bills. It seems unlikely that a society can remain politically stable when a huge majority of some future generation realizes they were born with an obligation to pay taxes to some minority of their age cohort. (Why would your kids want to pay taxes to Paris Hilton's kids?) A populist future government might choose to cancel the debt, or perhaps increase the estate tax to prevent the propagation of enormous debt legacies. But of course any attempt to renege on obligations could create all sorts of problems such as wrecking the credit rating of the U.S. government which allows it to borrow at low rates currently. I'm not an expert on these issues but I think that's basically how government debt works - it's basically a way for poorer people to consume some of the rich people's wealth in exchange for the promise that someone will pay it back later. --Teratornis (talk) 07:03, 16 May 2008 (UTC)

- I might add that one rarely hears it spelled out that way, as if there is some kind of deliberate or accidental conspiracy to keep most of the poor taxpayers in the dark about what they are doing to their kids. To see which side you are on, compare the per capita national debt to your treasury bond portfolio. If you hold more than your per capita share of the debt, then other taxpayers are promising they or their children will pay you or your children (or your estate, or whoever gets your t-bills) back, with interest. --Teratornis (talk) 07:10, 16 May 2008 (UTC)

- What "the US owns half its own debt" means is that large numbers of Americans have obligated their children to pay debt service in the form of taxes to the children of the tiny minority of Americans who have enough wealth to hold significant amounts in treasury bonds. Wealth in the U.S. follows a Pareto distribution, which means the top 1% of U.S. citizens by wealth hold a huge fraction of the total wealth. They lend lots of it to the U.S. government, so the majority of U.S. taxpayers may consume a greater value in public goods than they pay for with their taxes. In return, these taxpayers agree to obligate future taxpayers to pay service on the debt. Since lots of that debt will remain outstanding for decades, effectively that means middle and low-income taxpayers are selling their children into a kind of indentured servitude to whoever inherits all those T-bills. It seems unlikely that a society can remain politically stable when a huge majority of some future generation realizes they were born with an obligation to pay taxes to some minority of their age cohort. (Why would your kids want to pay taxes to Paris Hilton's kids?) A populist future government might choose to cancel the debt, or perhaps increase the estate tax to prevent the propagation of enormous debt legacies. But of course any attempt to renege on obligations could create all sorts of problems such as wrecking the credit rating of the U.S. government which allows it to borrow at low rates currently. I'm not an expert on these issues but I think that's basically how government debt works - it's basically a way for poorer people to consume some of the rich people's wealth in exchange for the promise that someone will pay it back later. --Teratornis (talk) 07:03, 16 May 2008 (UTC)

- Lindsay Williams is a "conservative Baptist minister." I wonder if he believes all the oil is 6000 years old? --Teratornis (talk) 07:21, 16 May 2008 (UTC)

I'm sure that when peak oil really happens he will turn around and say that the world's sins have caused God to stop the flow of the earth's oil. ROFL. Seriously, we definitely need to include prophet Lindsey Williams once his existence hits mainstream news. He has written a book on his conspiracy theory which is published online and in paperback Lindsey Williams (1980-7). The Energy Non-Crisis. Worth Publishing Co. {{cite book}}: Check date values in: |date= (help). Here is another article on the Lindsey Williams conspiracy: "How large is Prudhoe Bay?". Williams claims to have witnessed a huge oil discovery at Gull Island (5 miles north of Prudhoe Bay in the Beaufort Sea) that could have produced so much oil, that the official said that another pipeline could be built "and in another year's time we can flood America with oil- Alaskan oil ... and we won't have to worry about the Arabs." However, a few days after the find, the Federal Government ordered the documents and technical reports locked up, the well capped, and the rig withdrawn. But it's not until recently that he's started with his no-peak oil rants on YouTube.Kgrr (talk) 13:53, 11 July 2008 (UTC)

Is It Really Peak Oil Now?

Not trying to stir up bickering debate but:

1) is there yet scientific consensus about whether oil is peaking or not? What about supposed huge new reserves?

2) under the subheading "Energy Information Administration and USGS 2000 reports" it says "The U.S. Energy Information Administration projects world consumption of oil to increase to 98.3 million barrels per day (15.63×106 m3/d) in 2015 and 118 million barrels per day (18.8×106 m3/d) in 2030.[90] This represents more than a 25% increase in world oil production". Was that last word supposed to be "consumption" instead of "production" since that's what the paragraph was talking about? Or is is just worded badly? —Preceding unsigned comment added by 4.246.200.37 (talk) 17:38, 20 May 2008 (UTC)

- Well, you should start by reading the discussions of this very topic on this talk page and the talk:petroleum page. The huge reserves you refer to are not fully recoverable with current technology (2-3 billion barrels, or less than a month's worth in the case of North Dakota), and because of the technical difficulties involved in many cases will take billions of dollars and up-front investment and at least 10 years to produce anything at all. It's important to look at the p90 or p95 EUR (90 or 95% confidence of total recoverable reserves) instead of the often quoted p5 or p10 (which is what you see in the news).

- I have corrected the sentence you mentioned in the USGS section. I hope this is clearer language. NJGW (talk) 01:54, 21 May 2008 (UTC)

- Thanks NJGW. I am familiar with Peak Oil but it seems that within the past few years or so I'm suddenly hearing of these new, large discoveries and I have to wonder how it changes the debate. I'm no expert on the subject but I've felt that while warnings are appropriate, definite predictions of an emminent peaking seemed somewhat premature, especially if the experts don't all agree and if they are still finding more. I tend to think that smug predictions can come back to bite one on the A-s. Of course physics dictates that we will run out at some point (if we don't find alternatives) and whether or not we have Peak Oil sooner rather than later we should clearly be weaning ourselves off the stuff ASAP. It's damaging in so many ways (wars, plastic pollution, lot's of health effects, global warming etc.) That much there is no debate on. It's unconscionable that we have not moved wholesale into alternatives by now. But I guess big energy wouldn't want that.4.246.202.26 (talk) 06:45, 21 May 2008 (UTC)

- It's instructive to look at the oil extraction history of the U.S., which peaked in 1970 at 9.6 million bbl/day, and declined to 5.1 million bbl/day by 2006. There were several large oil discoveries after the peak which put some bumps on the decline curve. Without those discoveries, the decline would have been much steeper - the U.S. would have nearly exhausted its petroleum reserves. Since oil exploration and extraction occurred earlier in the U.S. than in much of the rest of the world, U.S. oil extraction history might predict how oil extraction will play out in the world as a whole. There is no guarantee of this, but it's all we've got. Therefore, we note:

- When the U.S. was

3836 years past its peak, domestic oil production was still hanging tough at a bit more than 53% of peak level in 2006. - However, domestic oil consumption approximately doubled during that time, with the difference made up with skyrocketing imports.

- When the U.S. was

- If the U.S. history predicts the future of world oil extraction (and this might be optimistic for various reasons, such as the wider use today of enhanced recovery technology which has the effect of maintaining peak production longer from large fields and then creating steeper drop-offs), we can expect that even 30-40 years after the world peaks, the world might still be extracting an absolutely large amount of oil, but this might be only a quarter or less of the amount of petroleum the world population would like to be burning by then. Try to imagine what it will take to destroy 75% of the demand for petroleum over the next several decades. That's the scale of the problem. --Teratornis (talk) 16:55, 21 May 2008 (UTC)

- It's instructive to look at the oil extraction history of the U.S., which peaked in 1970 at 9.6 million bbl/day, and declined to 5.1 million bbl/day by 2006. There were several large oil discoveries after the peak which put some bumps on the decline curve. Without those discoveries, the decline would have been much steeper - the U.S. would have nearly exhausted its petroleum reserves. Since oil exploration and extraction occurred earlier in the U.S. than in much of the rest of the world, U.S. oil extraction history might predict how oil extraction will play out in the world as a whole. There is no guarantee of this, but it's all we've got. Therefore, we note:

- Thanks NJGW. I am familiar with Peak Oil but it seems that within the past few years or so I'm suddenly hearing of these new, large discoveries and I have to wonder how it changes the debate. I'm no expert on the subject but I've felt that while warnings are appropriate, definite predictions of an emminent peaking seemed somewhat premature, especially if the experts don't all agree and if they are still finding more. I tend to think that smug predictions can come back to bite one on the A-s. Of course physics dictates that we will run out at some point (if we don't find alternatives) and whether or not we have Peak Oil sooner rather than later we should clearly be weaning ourselves off the stuff ASAP. It's damaging in so many ways (wars, plastic pollution, lot's of health effects, global warming etc.) That much there is no debate on. It's unconscionable that we have not moved wholesale into alternatives by now. But I guess big energy wouldn't want that.4.246.202.26 (talk) 06:45, 21 May 2008 (UTC)

Allow me a slight paranoia. Since W & Co. have been in office there have been some disturbing but coincidental tragedies and other bad news that seem to result in neo-con policies that turn out to be just what they wanted all along. 9/11 resulted in an invasion of Iraq which we now know was what they planned even before that day [3][4]. In this case hard line conservatives have tried just about every trick in the book to obtain drilling in ANWR, National Parks and offshore but have been consistantly stymied by environmentalists and the general populace. Now that W has just months left in his reign suddenly oil prices are shooting up (it does seem rather sudden, and apparently the price of gas has been manipulated in the recent past with the help of the Sauds [5][6]). Predictably Bush and the neo-cons are using the present price hikes as an excuse to demand that drilling [7][8]. A false Peak Oil would benefit the oil companies. Now they can charge 2 to 3 or more times what they charged just a few years ago for the very same quantity of gas and blame it on Peak Oil. Another example is the current world food price crisis which seemed to come out from nowhere. Europe has steadfastly refused GMOs despite the fact that the US has been trying for years to ram it down their throats. But now with this sudden crisis they are being almost forced to accept it [9]. It's the suddeness and timing of these events that has got me suspecious. Brother, can you spare a dime? 4.246.200.43 (talk) 04:19, 22 May 2008 (UTC)

"There’s a few hedge fund managers out there who are masters at knowing how to exploit the peak [oil] theories and hot buttons of supply and demand and by making bold predictions of shocking price advancements to come, they only add more fuel to the bullish fire in a sort of self fulfilling prophecy." — National Gas Week, Sept. 5, 2005 as reprinted in the US Senate Permanent Subcommittee on Investigations’ report, "The Role of Market Speculation in Rising Oil and Gas Prices," June 27, 2006. More at [10]. I get the sneaking feeling that those secret meetings that Cheney had with all those oil execs at the beginning of W's reign which the WH has steadfastly refused to reveal would be ... interesting. "It would be interesting for Congress to subpoena the records of the futures positions of Goldman Sachs and a handful of other major energy futures players to see if they are invested to gain from a further rise in oil to $200 or not.... Oil speculator T. Boone Pickens has reportedly raked in a huge profit on oil futures and argues, conveniently that the world is on the cusp of Peak Oil. So does the Houston investment banker and friend of Dick Cheney, Matt Simmons" [11]. 4.246.200.203 (talk) 17:02, 22 May 2008 (UTC)

More: "No supply crisis justifies the way the world's oil is being priced today. .... The major problem faced by Big Oil is not finding replacement oil but keeping the lid on world oil finds in order to maintain present exorbitant prices.... The refiners today are clearly trying to draw down gasoline inventories to bid gasoline prices up" [12]. Again, I'm not claiming that the current crisis is not Peak Oil related, but that it's the suddeness and timing of these events that has got me suspecious. "Thursday, light, sweet crude futures breached $135 a barrel, more than double the price a year ago" [13]. If anything, if it is manipulation this is further strong argument for why we should be weaning ourselves off this black death. I wouldn't put it past these guys, would you? Being held hostage by the sharks in Big Energy, which has shown nothing but disdain for environmental protection, and have consistantly rewarded themselves with the fattist of salaries and bonuses while little old ladies and struggling single moms try to pay exploding costs to heat their homes is quite enough reason. We need de-centralized renewable alternative energy NOW! 4.246.203.6 (talk) 16:38, 25 May 2008 (UTC)

- Well, this is quite a debate. I think the basic question was:

- 1) "is oil is peaking or not?" The answer I could offer, based on 35 years experience in the oil industry, is "Nobody knows." However, many people are getting darn suspicious that it might be. To cover the specific instances given:

- Iraq - Nobody actually knows how much oil is under those western deserts, but they can make assumptions. Nobody is going to drill any wells while people are shooting rocket-propelled grenades at them, so it may be a while before we find out for sure.

- Brazil - It's a nice time to be a Brazilian. You have decades of guaranteed employment to come while they spend hundreds of billions of American dollars proving up those resources. It's less nice if you are an American who may or may not be able to buy some of that oil in decade or so.

- Arctic - I once worked for a company that ran a fleet of 23 ships in the Arctic. They drilled a lot of wells and found a bit of oil. Not enough to be worth producing, so they abandoned all the wells and wrote off the costs. Maybe somebody else will be more lucky this time. The Arctic, by the way, is gas prone, not oil prone.

- Montana and North Dakota - Don't forget Saskatchewan, too. Saskatchewan is now officially rich, Montana and North Dakota may become so, too. The Bakken formation may produce a large amount of oil over a very long period of time, possible raising the U.S. decline curve to the point where the difference is actually visible to the naked eye. But not much more than that.

- 2) Energy Information Administration and USGS reports. These organizations have always been wrong before (notably about the U.S. oil peak) Why would anyone expect them to be start being right now? RockyMtnGuy (talk) 19:03, 25 May 2008 (UTC)

Well Congress ought to be investigating and if it turns out that Big Oil is manipulating the prices for its benefit I would suggest an immediate two prong response, 1) Jail those responsible and 2) do a Venezula and nationalize oil, then set the price fairly. 4.246.206.176 (talk) 12:16, 26 May 2008 (UTC)

- You're possibly not aware that over 80% of the world's oil reserves are already under the control of state-owned oil companies. Not many of them are friendly to the U.S., Petroleos de Venezuela being a case in point. The largest privately owned oil company, Exxon Mobile, has less than 1/30 of the reserves of Saudi Aramco, the biggest oil company of all. Second and third by reserves are the National Iranian Oil Company and the Iraq National Oil Company. Second and third by production are Petroleos Mexicanos and Petroleos de Venezuela. As it happens, Congress has recently passed a bill allowing people to sue members of OPEC for creating an oil monopoly. Of course, OPEC is an oil monopoly, but I don't think that suing them is going to help. If you force the issue, they'll probably just shut off the oil and wait while you reconsider.RockyMtnGuy (talk) 21:04, 26 May 2008 (UTC)

Thanks for your comments. No, what I'm saying is that if what's happening in the U.S. is the result of or largely the result of manuipulation on the part of American oil companies and/or speculators, and many are saying it could be as I linked to above, then Congress should act. 4.246.201.22 (talk) 03:02, 27 May 2008 (UTC)

- Out today Record gas prices: 20 straight days. "NEW YORK (CNNMoney.com) -- Retail gas prices hit record highs for the 20th day in a row, motorist group AAA's Web site showed Tuesday". Peak Oil or Gouging? 4.246.205.100 (talk) 18:45, 27 May 2008 (UTC)

- The U.S. Congress has limited control over the issue. George Bush's response was to invade Iraq, and we know how well that went. The U.S. now imports 2/3 of its oil as well as a lot of its refined products (there hasn't been a new oil refinery built in the U.S. in over 30 years). Refinery profits are down because oil prices have been running ahead of fuel prices, so they're just now playing catch-up. U.S. fuel prices are considerably less than most places in the world, so there's still lots of upside potential on price. Chinese consumption is continuing to increase, and no oil suppliers other than Saudi Arabia have any surplus capacity. So, if world oil production peaks and starts to decline, expect the effects to be worse in the U.S. than other countries which are already used to high prices. RockyMtnGuy (talk) 19:35, 27 May 2008 (UTC)

Another reason for high prices: "Iraq War May Have Increased Energy Costs Worldwide by a Staggering $6 Trillion" "The invasion of Iraq by Britain and the US has trebled the price of oil, according to a leading expert, costing the world a staggering $6 trillion in higher energy prices alone. The oil economist Dr Mamdouh Salameh, who advises both the World Bank and the UN Industrial Development Organisation (Unido), told The Independent on Sunday that the price of oil would now be no more than $40 a barrel, less than a third of the record $135 a barrel reached last week, if it had not been for the Iraq war" [14]. Now it looks like W's planning to sabotage the next Presidency as well and make sure we're so mired in war that we'll never get out of it. "NEW YORK - The George W Bush administration plans to launch an air strike against Iran within the next two months, an informed source tells Asia Times Online, echoing other reports that have surfaced in the media in the United States recently" [15].

About nationalizing oil, as outright nationalization (simply taking over the oil companies) would prove to be highly contentious (though in the long run it would be a good solution), the U.S. government ought to start by going into competetion with Big Oil in the U.S. and abroad. The reverse of Bush and the neo-con-artist's "privatize everything" philosophy. Private corporations exist to make a profit, the government exists, in large part, to provide services, not to make a profit. The competition would force Big Oil to stop the shenanigans and bring down their prices. Of course Big Oil, which has created numerous "think tanks" otherwise known as 'liars for hire' to combat or delay as long as possible any change that might cut into their profits, such as any real action on climate change, would be all over it with tales of disaster if the government steps in. 4.246.207.183 (talk) 12:00, 29 May 2008 (UTC)

- The Canadian government thought somewhat the same as you after the 1973 oil crisis, so in 1975 it started a government-owned oil company called Petro Canada. As a result of this it discovered a couple of interesting things:

- It is possible to lose money in the oil business, if you don't know what you are doing. Petro-Canada probably cost them somewhere between $8 and $16 billion in total, including all the tax breaks, subsidies and special deals they had to make to keep it running.

- The multinational oil companies are very efficient. They could make a profit selling gasoline at the same price Petro Canada was losing money at. Despite its mandate to force oil prices down, Petro-Canada kept trying to force them UP so it wouldn't lose so much money.

- Eventually the Canadian government decided that running a money losing oil company selling high-price gasoline wasn't a lot of fun, and they privatized Petro-Canada. It is now doing very well and made $2.6 billion in profit last year. You probably don't know this, but they made a lot of it from you. Canada now exports more oil and refined products to the US than it consumes itself. I'm sure they appreciate having your business.RockyMtnGuy (talk) 05:07, 30 May 2008 (UTC)

I think the key comment you made above is "It is possible to lose money in the oil business, if you don't know what you are doing". Apparently in the case of Petrol-Canada it wasn't well thought out and was sort of a knee-jerk response to 1973. I'd hope that this time around the same mistakes would not be made. But I don't believe that somehow only the Big Oil companies have a natural ability to run an oil business. I'm not suggesting that the government sell gas at a loss, but at price to at least cover their costs. The fact that American Big Oil companies are reporting record profits shows that there is a lot of unnecessary profiting going on and room to lower the price. There's a difference between making a profit and making a killing. BTW, I noticed a tag at the bottom of that page that says "This article does not cite any references or sources". 4.246.201.206 (talk) 14:24, 30 May 2008 (UTC)

- I can't help with the Petro-Canada article, all my information comes from unquotable sources. Oil companies keep a close eye on each other in case someone else hits something big, and by "close eye", I mean with binoculars and telephone descramblers. Besides, the topic is still highly political in Canada and would lead to edit wars.

- There's no reason to believe a government knee-jerk response to price increases in 2008 would be any different than a government knee-jerk response to price increases in 1973. Governments are generally unsuited to running oil companies, or any kind of company where operating efficiently is a necessity.

- However, the real reason the multinational oil companies are making so much money is that they have run out of places to drill for oil, so they're essentially liquidating their assets by producing all the oil and distributing all the value to shareholders. At the end of it all, they'll just hang up a big "Gone out of business" sign and retire to a golf course.RockyMtnGuy (talk) 18:43, 30 May 2008 (UTC)

"the real reason the multinational oil companies are making so much money is that they have run out of places to drill for oil". Well that is the question. And as I've been saying, some people are saying that there's still lots of oil left (the four examples I posted at the beginning of this section, to which you added Saskatchewan, are rather sizable) and that Big Oil is simply using the issue as a handy excuse to rake in record profits, sitting on finds and determined to ride out this gravy train as long as they can. Additionally, as per my comments at 04:19, 22 May 2008 above, they are also using the issue as a convenient excuse to push hard for drilling that they've been stymied in for decades. Again, it's the suddeness and timing of these events that has got me suspecious. I won't be at all surprised if, after awhile, they suddenly announce "Hey! Look what we just found!". That is unless they can convince everyone that oil is about to run out, then they can turn down the spigots and keep charging through the nose indefinitely. The financial motive is there. Maybe it is Peak Oil (and if so raises the question as to why Big Oil has been all but silent on the issue to the last moment) but one thing is clear, with questions in abundance there needs to be an ALL OUT investigation to settle the issue. Agreed? 4.246.206.221 (talk) 01:54, 31 May 2008 (UTC)

- No, it's not all that sudden. Prices have been rising since about the year 2000. For years, people have been saying, "World oil production will peak in 20xx", and only the xx has been in dispute. The oil companies would like to dearly love to drill in places like the Alaska Wildlife Reserve or offshore Florida mainly because those are the only places they haven't drilled yet. The rest of the US looks like a giant pincushion.

- Sure, the government can investigate the futures market, but these investigations usually determine that it's just business as usual. The futures market mostly consists of buyers for oil refineries, who want to lock up a future supply of oil, and sellers for oil companies, who want to lock in a good price. The problem arises when buyers try to buy oil x months in the future, and the sellers say "Sorry, we're sold out x months in the future." At that point the buyers panic and start to try to outbid each other, and they can bid high because they know that you, the consumer, will not balk at paying whatever it costs. The way to defeat this is to not buy. Walk or ride a bicycle instead. If you don't buy, the price for everyone else will go down.

- The examples you posted at the start of this section are examples of pie in the sky. Nothing on that list is going to come on production for a decade, if ever. Meanwhile, the supply problem is now: Mexican production has fallen 400,000 barrels per day since the start of the year, Russian production has been falling since the start of the year, North Sea production has been falling for years, Alaska production has been falling for years, Indonesian production has fallen to the point that Indonesia dropped out of OPEC. People were hoping the Saudis could step in to fill the gap, but they don't seem interested (or maybe they don't have the oil.)

- So, as you can see, its a global problem. In the US, production peaked and started falling 28 years ago despite everyone's best efforts. There's no reason to believe that the rest of the world will be any different than the US, but people want to believe that cheap oil will go on forever. It's like believing in perpetual motion. RockyMtnGuy (talk) 18:21, 31 May 2008 (UTC)

"No, it's not all that sudden". Again, "Thursday, light, sweet crude futures breached $135 a barrel, more than double the price a year ago" [16]. "People want to believe that cheap oil will go on forever". That's not me. My issue, as I've made clear, is that I think that there is reason to believe that the present oil crisis is not as simple as just saying "Peak Oil" and that there could well be some shenanigans going on. I'm just not willing to let Big Oil off the hook and give them the benefit of the doubt when one considers their long history of deception [17] or let them keep their ill gotten gains if they are cheating.

A May 2008 issue of a newsmagazine called "Journal Plus Magazine of the Central Coast" I picked up recently has an article (sorry, no link) about someone named "Al Stevens", whose latest occupation was as COO of Southwestern Energy Production in Houston, Texas. The article title is "The State of Gasoline - From an Oilman. Here's a quote: "'The world is not running out of oil or natural gas,' says Stevens firmly, a veteran geologist and around-the-world wildcatter who has also been part of managerial boardrooms for multinational oil companies including Chevron Oil, Exxon Oil Company, and Occidental Petroleum. 'In truth there is still a great deal of oil left to be recovered, and we're not running out anytime soon,' he continues.... Stevens says there is a great deal more oil yet to be discovered even in the United States.... 'It's just that the most promising areas are being held off the market for a lot of reasons right now' explains Stevens." Though he acknowledges that light, sweet crude discoveries are running lower.

While I'm no expert, the fact is that those who should know still have widely varing opinions on the matter. Some say there is still lots of oil left and blame high oil prices on fraud, some on the occupation of Iraq, some on unrest in Nigeria, some on market speculation, some on supply and demand, some on Peak Oil, etc. Sure it's a combination of all those things but in what proportions? And how much of the standard explanations which Big Oil wants us to swallow is just "spin" [18]. You yourself stated above "is oil is peaking or not?' The answer I could offer, based on 35 years experience in the oil industry, is 'Nobody knows.'" Clearly there exists a lot of uncertainty and that shows the need for a major settling of this important issue by unbiased sources. "So, as you can see, its a global problem"; doesn't it seem coincidental that most of the world's oil supplies seem to be peaking at about the same time [19]. Anyway, as I'm repeating myself and as I see that others below are objecting to these long discussions, I think I should wrap it up now. 4.246.204.120 (talk) 02:04, 1 June 2008 (UTC)

- Yes, it is getting rather verbose. The "Nobody knows" response I gave is better addressed in the predicting the timing of peak oil article, which points out "...the only reliable way to identify the timing of peak oil will be in retrospect". However, based the US peak of 1970, the global peak will come as a complete shock to a lot of people, many of them experts. At this point in time peak oil is theory, so it should be presented as such, with the caveat that people should be prepared for it to happen because it will inevitably happen sometime. Maybe now is the time.

- And, no, all the world's oil supplies are not peaking at the same time. The U.S. peaked about 30 years ago. The North Sea peaked in the late 1990's. Mexico peaked just a few years ago. Canada and Brazil have some time to go before they peak. However, the global peak will occur when the declining countries outweigh the growing countries.

- The popular press is not a good source for this article because reporters don't really know anything about the subject but are willing to speculate at great length. Press releases by foreign governments and oil companies are not that good either. Politicians are really bad because they know nothing but are always trying to find a scapegoat when they screw up. Government agencies tend to distort the facts because they have their own political agendas. The trade journals are probably your best source but first, you have to know where to find them and second, you have to know how to read them. As far as definitive studies are concerned - the International Energy Agency is conducting a review of the subject and will publish a report in November. Reportedly it's much more pessimistic than their previous studies. Somebody can cite it at that time. RockyMtnGuy (talk) 07:00, 1 June 2008 (UTC)

- If it is Peak Oil they should have been easing us down, weaning us off and moving us to renewable alternatives decades ago rather than a sudden jolt. That's a scandal in it's own right. Anyway, thanks for the discussion RockyMtnGuy. 4.246.207.140 (talk) 13:11, 1 June 2008 (UTC)

(undent) With respect to the comment by Special:Contributions/4.246.203.6: "Again, it's the suddeness and timing of these events that has got me suspicious", see the Hirsch report, which explicitly claims peak oil could occur without warning. Also try searching Google Scholar for: peak oil and read some of those scholarly papers from the 1990s and early 2000s. Even when oil was selling near historic inflation adjusted lows, people who understood Hubbert peak theory were predicting the end of cheap oil, and subsequent events probably do not seem "sudden" to people who expected them for ten years or more. --Teratornis (talk) 22:31, 8 June 2008 (UTC)

- Not to reopen this discussion but I think there's no denying that the current oil price crisis is about much more than peak oil. Some quotes from a Reuters story that, though it does warn about peak oil, makes clear that there's more going on here - which is what I was getting at, "DUBAI (Reuters) - OPEC members saw no need on Sunday to pump more oil in response to last week's double-digit surge in oil prices to over $139 a barrel that top exporter Saudi Arabia described as unjustified.... But Saudi Oil Minister Ali al-Naimi and his Pakistani counterpart met on Sunday and agreed that the price rise was unjustified and unrelated to market fundamentals, the official Saudi Press Agency reported.... OPEC blames factors beyond its control, including speculation and international political tension, for the price rises.... Iran is OPEC's second largest oil producer and the deepening dispute with the West over Tehran's nuclear ambitions has contributed to oil's rally.... Iran has large volumes of crude sitting in tankers offshore waiting for buyers.... Iraq expects its exports to hit a five-year high in June" [20]. So, among other factors, a big part of the price crisis is related to the US and other countries fighting of Israel's war. And, as I outlined above, I think there is good reason to suspect both the suddeness of the price increases and their timing. 4.246.206.98 (talk) 07:05, 10 June 2008 (UTC)

There seem to be several paradigms at work with the oil prices:

- Supply and demand

It is thought by some that we are in Peak oil since 2006. Peak oil is the point in time when the maximum rate of global petroleum extraction is reached, after which the rate of production enters terminal decline.

Peak oil is not about running out of oil, it's about the rate at which oil can be supplied to the market. If the rate at which it is demanded exceeds the rate at which it can be supplied, oil prices will go up.

- Inflation / Declining Dollar

In an attempt to stimulate the ailing U.S. economy, the the Federal Reserve has cut rates by three percentage points since September 2007. But the rate cuts are also inflationary, weakening the dollar and sending oil prices higher.

Since the oil price is indexed to the dollar, as the dollar drops in value, the price of oil increases. If one looks at inflation adjusted oil prices, they remain relatively flat.

- Speculation

As the dollar continues to depreciate in value, investors have bought oil futures as a hedge against inflation. It is thought that as much as 60% of today's crude oil price is pure speculation driven by large trader banks and hedge funds.

- War

Oil prices are high because the United States is actively engaged in wars in Iraq and Afghanistan and perusing war with Iran in the middle east.[11]

- Resource Nationalism

"Resource nationalism" and political tensions in Nigeria, Venezuela, Iran and even Mexico are further constraining supply. These oil producing countries would like to use the oil in their countries to develop the country rather than to make the oil available to world markets.

Is this a section we need somewhere in a separate article Oil price?Kgrr (talk) 19:17, 27 July 2008 (UTC)

- While I agree with most of the items listed above, a couple of things nag at me about it... I've heard the "60% of the price" is speculation thing before (arrived at I believe by more or less "keystoning" the cost of producing oil, or taking production costs per barrel and doubling it). I don't believe such logic necessarily applies to a resource such as oil when it has an increasingly constrained supply, and I've also heard, and tend to believe, that speculation plays a relatively small role in today's prices, and that only a relatively small percentage of oil is traded under futures contracts. The value of the US dollar also has an obvious effect, but I believe if you do the math that only accounts for a small part of the recent price run up. I don't believe Mexico is allowed to participate in the "resource nationalism" you describe under part of NAFTA, I know Canada isn't. Also, I don't believe Iran and Venezuela are keeping significantly more oil for their own needs than they were before the price run up, and in the case of Nigeria its exports continue to grow suggesting it should have had the opposite effect on prices (oil production in Venezuela has been dropping, according to some due to poor reinvestment in further developing fields to maintain and grow it). That said, political tensions in such large producers do create nervousness in the market, and in the case of Iran they could be able to disrupt tanker traffic in the Straight of Hormuz which would significantly impact oil exports from a number of other large producers in the region. TastyCakes (talk) 01:10, 28 July 2008 (UTC)

- This discussion hasn't been what it started as for a while. Now it's into territory best covered at talk:Oil price increases since 2003. I propose we move it there to generate the proper discussion and resolution (if any). NJGW (talk) 10:19, 28 July 2008 (UTC)

- Most of the issues above, particularly the "60% of the price is speculation" issue were nicely covered off by the report recently released by the U.S Commodity Futures Trading Commission called the "ITF Interim Report on Crude Oil". As you may recall, the U.S. Congress recently called for an investigation into oil futures trading and whether it affected oil prices. "ITF" stands for the Interagency Task Force from the U.S. Departments of Agriculture, Energy and the Treasury, the Board of Governors of the Federal Reserve, the Federal Trade Commission, and the Securities and Exchange Commission. The reports conclusion: No, it wasn't speculators, it was fundamentals. And by fundamentals, they implicitly mean that world oil production is really peaking. Now. You should read it, it has a lot of good basic information about world oil markets in it. See [21] RockyMtnGuy (talk) 17:44, 28 July 2008 (UTC)

A bit too centered on US lifestyle

I think that, while it is clear that a peak in global oil production would affect most of the world's population in some way, the article represents it still a bit too much from the point of view of the American Way Of Life (TM). While a rise in transportation cost may be, in fact, a huge problem for people living in suburbs which are only reachable by cars, one might consider the fact that only a extremely small part of the world's population has that living arrangement.

In north America, it may be an exciting idea to live in cities with "new walkable urbanism" in which most activities can be performed by going there by foot; in many places of Europe, this is still a living tradition and a single person can easily and comfortably live without need for a car. For example, I and my four siblings all have an university degree. Four of us never had a car, one of my brothers is using one recently because they have a little kid, but they could do without when necessary. Now, think of the huge part of the world's population who never will be able to afford to go to work by car. It would be quite amusing to them to hear that for north american citizens, it looks like the end of civilization if they can't continue that way. Especially if they know that, on average, every US citizen uses roughly sixty times more energy than the average citizen of the world.

Of course, for people elsewhere, there will be enormous difficulties to be solved, but they probably can. There will be shortage of cheap transport and agriculture may need to be adapted drastically. However, often it is not even clear that industrialized, export-oriented agriculture has helped to supply people with food; many times home-grown food consumption has been replaced by export production. This is, for example, one of the reasons, why in the Philippines now there is a shortage of cheap rice. (Joise) --82.113.121.16 (talk) 10:00, 25 June 2008 (UTC)

- The United States has about 5% of the world's population and consumes about 25% of global petroleum extraction. I'm not sure where you get the "sixty times" figure, even if we consider all energy sources; the correct factor for petroleum is that the average U.S. citizen consumes roughly fives times the world per capita average (i.e., the mean; the median world per capita petroleum consumption is probably lower than the mean). As the world's largest petroleum consumer and importer, the U.S. will figure largely in any decline in petroleum extraction. This is already evident in the 2007–2008 world food price crisis, in which we see the linkage between price rises for energy and food. (Industrial agriculture converts fuel to food, while biofuels production converts food to fuel - therefore, fuel and food are to some degree substitute goods, so market forces are now determining how many poor people must go hungry to enable the wealthy to enjoy their energy-rich lifestyle.) Many other nations depend on the U.S. for its food exports, and/or as a place to sell their goods and raw materials, so any substantial disruption to the U.S. economy will reverberate around the globe. Political instability in the U.S. could be particularly dangerous, considering the size and potential lethality of the U.S. military.

- How fast the U.S. reduces its petroleum consumption will determine how much of the petroleum "pie" is available to everybody else, especially to the world's poor who cannot outbid the rich for a dwindling supply of petroleum. The world's poorest billion people subsist on a per capita income of about $1/day; the next poorest 2 billion on about $3/day. People with such low incomes do not consume much petroleum, but much of what they do consume is indirectly in the form of inputs to modern agriculture. Petroleum made the green revolution possible, which multiplied farm yields and allowed the world population to explode to nearly 7 billion from its pre-petroleum size of less than 2 billion. Take away the petroleum faster than people can find substitute technologies, and agricultural output could collapse to pre-petroleum levels, along with the global population. The 1 to 3 poorest billion people who are first in line to starve therefore have a strong interest in how the U.S. and other large petroleum consumers handle their oil end-game.

- Note that even though most European nations have more efficient economies than the U.S. (with the possible exception of Iceland, which burns much petroleum to fuel its cars and fishing boats, but plans to shift to a hydrogen economy "by 2050" - a projected date that should cause any doomer to laugh out loud), all modern economies have per capita consumptions of petroleum and total energy well above the world average. Even those charming walkable communities in Europe are probably using too much energy to survive a rapid and severe reduction in world oil extraction. We're seeing the first signs, with the protests by lorry drivers over high fuel prices, and that is just from world oil extraction having hit a plateau since around 2005. Since the start of the plateau, the world has added about 250,000,000 new people, and all of them have to be fed with petroleum, since non-petroleum-based agriculture probably cannot feed more than a small fraction of the people we have now.

- In any case, Wikipedia should take a global perspective. Since the impacts of peak oil will be so extensive, we might eventually create separate articles to detail the impacts on individual countries or regions. One single article won't suffice, when virtually every nation will have to redesign its economy if it is going to survive. For example, every nation should adopt a One-child policy immediately. Incidentally, try to imagine the mess we'd be in now if China had not done the world a huge favor by adopting that policy in 1979. Peak oil might instead have occurred several years earlier, when we were even less prepared than we are now. --Teratornis (talk) 21:10, 26 June 2008 (UTC)

- Are there specific edits we need in order to ensure the article is less US-Centric? Kgrr (talk) 14:58, 10 July 2008 (UTC)

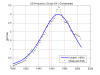

Graph

I think this graph:

must be either lower 48 only or onshore lower 48 only, because if you work it out, 1.5 billion bbl per year/365 is 4.1million bbl/day, but US oil production is about 7.61million bbl/day according to google. Does anyone know the details? I think the caption should reflect what the graph is actually showing. TastyCakes (talk) 15:06, 29 June 2008 (UTC)

Hmm this graph also:

Upon closer inspection, it seems the data from these graphs comes from EIA while the data google shows is from the CIA world factbook for 2005. I don't know what causes the discrepency... Possibly the CIA data includes NGLs, condensate and refinery gain? TastyCakes (talk) 15:24, 29 June 2008 (UTC)

- I'm pretty sure the jump on the second graph between '79 and '85 is Alaskan oil. The first graph juxtaposed against Hubbert's prediction states at the image page that it is lower 48 only, which makes sense because Hubbert didn't count on Alaska when he made his prediction in 1956. NJGW (talk) 16:32, 29 June 2008 (UTC)

- I did the second graph from EIA data. The jump in the 80's is indeed the Alaska North Slope oil coming on stream after the Alaska pipeline was started up. The disconcerting thing about it is that the second peak was lower than the first and didn't modify the overall curve that much. Currently the U.S. is producing about 5.1 million barrels per day of crude oil and 2.2 million bpd of natural gas liquids. The only way you would get 7.61 million bpd is by adding the two together, and finding some bonus fuel somewhere else, which isn't really legitimate. Most of the propane and butane produced from natural gas wells is sold as propane and butane, or plastics, not gasoline or diesel fuel. And natural gas has its very own Hubbert's curve which looks very much like the oil one. RockyMtnGuy (talk) 03:37, 30 June 2008 (UTC)

- There's a lot oil/liquids confusion out there. It seems to be promoted by proeminent governments (and the media which cowers before them) actually. Maybe the article could do a better job of clearing that up. I found at least one instance of oil/liquids conflation in the article actually but I wasn't looking for it so there may be more waiting to be corrected... —Preceding unsigned comment added by 80.238.240.15 (talk) 10:08, 30 June 2008 (UTC)

- I think the last bit of discrepancy is from "refinery gain", although I won't pretend to have much idea what that involves. TastyCakes (talk) 14:41, 30 June 2008 (UTC)

- There is indeed a lot of confusion surrounding the difference between "crude oil" and "liquids". Part of the problem is that the popular press doesn't understand the difference so you're never sure what they're talking about. Technical journals are clearer, but you have to read them carefully to be sure what they're talking about. Some governments, such as Russia, never clarify what they are and are not including in their official figures so nobody really knows. "Refinery gain" is the difference between what a refinery inputs and what it outputs. U.S. refineries actually produce 44.65 gallons of products for every 42 gallons of oil that they input. This isn't creative accounting, it results from the fact that the density of their products is less than that of crude oil so the volume increases. On a mass basis, their inputs and outputs would be the same. RockyMtnGuy (talk) 04:04, 2 July 2008 (UTC)

What need to be done with the graph and its related paragraphs to fix the article? Let's list out the issues. Kgrr (talk) 12:55, 11 July 2008 (UTC)

References

Many recent editors have not followed the correct citation templates for the references. These need to be cleaned up. Please see Wikipedia:Citation templates and correct them. Anything not following the proper format will be deleted in two months 9/8/2008. If this sounds mean, tough. You guys wrecked the article since it was GA. Fix it. Kgrr (talk) 03:54, 9 July 2008 (UTC)

I will be working through the references again. Many of the references are not in the proper form for this article. There should not be any inline references. Mixing up the reference forms causes irregularities in the reflist at the end. The Wikipedia:Citation templates should be followed.Kgrr (talk) 18:20, 27 July 2008 (UTC)

- I'm still working slowly through the references, checking them, making sure they are complete, etc.Kgrr (talk) 14:36, 22 August 2008 (UTC)

Deletion of material

Please don't delete material which you feel is dubious. If you find dubious information that is not properly referenced in that paragraph, please follow the use with {{verify source}}. This will give the editor some time to properly reference the text. Kgrr (talk) 04:02, 9 July 2008 (UTC)

Revert of lead changes

Please discuss any changes to the lead before making them. We've spent a lot of time to get a consensus there.

Perhaps you are thinking of the Hubbert Peak theory. It basically says that the rate of petroleum production tends to follow a bell-shaped curve. The peak of that curve is not a theory, it's "peak oil", the name given to the point where the rate of production peaks. Kgrr (talk) 18:56, 2 October 2008 (UTC)

Greedy OPEC?

I wonder how OPEC plans to reconcile this paragraph:

"OPEC had vowed in 2000 to maintain a production level sufficient to keep oil prices between $22–28 per barrel, but did not prove possible. In its 2007 annual report, OPEC projected that it could maintain a production level which would stabilize the price of oil at around $50–60 per barrel until 2030.[1] On November 18, 2007, with oil above $98 a barrel, King Abdullah of Saudi Arabia, a long-time advocate of stabilized oil prices, announced that his country would not increase production in order to lower prices.[2] Saudi Arabia's inability, as the world's largest supplier, to stabilize prices through increased production during that period suggests that no nation or organization had the spare production capacity to lower oil prices. The implication is that those major suppliers who had not yet peaked were operating at or near full capacity.[3]"

with this news: Oil hits 12-month low, demand outweighs OPEC. Or are we just expected to drop this information down the Memory hole? NJGW (talk) 20:00, 9 October 2008 (UTC)

- One interpretation is that the world economy bashed its head against the ceiling of peak oil and bounced off, so oil traders are shorting oil in expectation of lower demand for oil during the global economic recession that everyone now predicts. However, it's also possible world oil extraction will begin to slide off its current plateau sometime in 2009, and drop by more barrels per day than the coming recession (if it actually occurs) would save. A recession does not mean everybody stops using oil. Another way to look at the current oil price slide is as a delayed demand destruction response to the surge in demand that had continued from 2005 to 2007 despite the leveling off of oil extraction. The world economy is like a control system with delays - it tends to react late, and then too strongly. Consider the analogy with trying to drive a car whose front wheels turn ten seconds after the driver turns the steering wheel. By the time the front wheels respond to the driver's control input, the driver will already have turned the steering wheel too far. Then the driver will overcorrect the other way, and on it will go (assuming the driver hasn't already wrecked). Richard Heinberg predicted the global economy would lurch back and forth this way as the world hits peak oil and slides down the oil extraction decline curve. There will be one recession after another, interspersed with temporary recoveries that drive up the oil price enough to kill demand and create the next recession. Since the amount of oil available keeps decreasing, each recession gets deeper, and each recovery more tepid. That's the peak oil doomer's view of things. At least we (may) now know that oil might not reach the spectacular prices some people have been predicting ($300/bbl and up), because it appears the global economy is too fragile to be able to pay that much. That is, people just can't generate enough value from the average barrel of oil to afford oil at such prices. Thus it may not require spectacular oil price rises to smash enough of the economy to keep demand in line with shrinking supply. But we'll have to wait and see. For example, what would it take to reduce world oil demand by as much as 10%? The Dow declining to 2,000? --Teratornis (talk) 22:29, 9 October 2008 (UTC)

What is with the price recent falls? Traders pricing in genuine fear of demand destruction. It doesn't take a geologist to understand that if you put enough economic pressure on people we'll create many sources of viable alternatives to substitute for oil. Even a child can understand what a Malthusian cannot. —Preceding unsigned comment added by 71.193.75.206 (talk) 08:55, 15 October 2008 (UTC)

- I just registered thats the english lemma elaborated vastly on Heinberg(!) as an oil expert but ignored statements as of Daniel Yergin of CERA Leonard Maugeri (in an wide spread Science article) and Dr. Christoph Rühls various statments on peak Oil flaws. Maugeri is CEO of ENI, Rühl chief economist of BP, their lips are read quite carefully by their shareholders but seemingly not by Wikipedians. --Polentario (talk) 15:16, 25 October 2008 (UTC)

- Of course a free market economy reacts to scarcity in one commodity by looking for substitutes, just as a person infected with the human immunodeficiency virus creates antibodies to fight the infection. However, the winner in such contests is not predictable - sometimes the response is insufficient. The world has examples of civilizations which collapsed after exhausting their resources, along with examples of civilizations which found substitutes and carried on. Petroleum replaced whale oil in the United States, but the Easter Islanders were not so fortunate. After they chopped down all their trees, they could no longer build fishing boats, so they experienced warfare, cannibalism, and a 90% population crash. Richard Heinberg is certainly on the pessimistic side, and he does overlook some obvious stopgaps. For example, Heinberg correctly points out that intensive agriculture depends heavily on ammonia produced from natural gas, but he doesn't mention Vemork - a dam and hydroelectric power station built by Norsk Hydro which produced hydrogen by electrolysis from 1911 to 1971, for the production of renewable ammonia. Heinberg and other doomers like to dismiss wind power as being unable to replace petroleum for transportation fuel. That is true enough at present, but already we could use wind power to generate ammonia fertilizer if we needed to. So there's a big fossil fuel input to agriculture that people knew how to replace with renewable technology back in 1911. That doesn't mean there's no problem; ammonia from wind power would cost more than ammonia from natural gas, so the price of food would go higher, and already the world has many impoverished people who spend most of their income on food and cannot afford to pay more.

- A more immediate problem for the wealthy nations is liquid fuel for transport. Passenger vehicles in the United States says the U.S. had an estimated 250,851,833 registered passenger vehicles in 2006, along with 7,667,066 passengers cars sold. Replacing the current vehicle fleet with something that can run on, say, electricity from wind power would take decades, even if we had the replacement technology ready to commercialize right now. (We aren't quite there yet, although electric vehicles are getting closer.) There is some maximum rate at which a country such as the U.S. can cut its dependence on petroleum while maintaining prosperity. We cannot instantly carpet the Great Plains with wind turbines, for example. It takes time to recruit and train the workers, build wind turbine factories, work out the logistics and siting, build the transmission lines, overcome NIMBYism, etc. The wind industry can only grow at some rate like 45% per year, which is vigorous growth, but would still take considerable time to make a significant dent. There is some maximum rate for replacing the vehicle fleet. If the supply of petroleum available for import to the U.S. should decline faster than the U.S. can comfortably handle, life in the U.S. will become increasingly uncomfortable. As we are seeing with the current financial crisis, our economic systems are absurdly fragile. We are already getting in trouble even before fuel shortages begin. How will we handle a genuine resource problem, if it proceeds on a schedule not of our choosing? --Teratornis (talk) 01:08, 5 November 2008 (UTC)

- I just registered thats the english lemma elaborated vastly on Heinberg(!) as an oil expert but ignored statements as of Daniel Yergin of CERA Leonard Maugeri (in an wide spread Science article) and Dr. Christoph Rühls various statments on peak Oil flaws. Maugeri is CEO of ENI, Rühl chief economist of BP, their lips are read quite carefully by their shareholders but seemingly not by Wikipedians. --Polentario (talk) 15:16, 25 October 2008 (UTC)

a very interesting graph

is presented here http://www.energybulletin.net/primer where little individual wells are being represented. It makes the idea enormously easier to understand and grasp in real-world terms. If it can't be re-used it should be reproduced, even without precise figures, as a representative concept. fs 11:57, 12 October 2008 (UTC)

- That is a good point, though it looks like that graph is completely made up (ie no data is used). If no one else gets a chance, I'll give it a try when I get some more time later in the week. NJGW (talk) 15:32, 12 October 2008 (UTC)

- Actually, we already have a more realistic version of the graph (at right). Do you think it makes more sense visually when all the individual pieces are on the floor of the graph rather than stacked on top of eachother? NJGW (talk) 15:36, 12 October 2008 (UTC)

- uh, the value of the graph in the url I posted isn't in the precision of numbers but the conceptual representation for grasping the concept, i.e.: "It doesn't matter if a well is opened after the peak and is going well, the overal view of the curve is still declining (at that point)" (the 'individual wells' bit). fs 21:51, 12 October 2008 (UTC)

- The graph on the right is a bit outdated. It shows production only til 2003 or so. Also, what I don't like about it is the projected future because it is biased. As you see the graph projects a significant decline in production til 2010. This is not quite what we observe so far. Therefore, I'd prefer to have a graph without 'future'. Here is an updated future-free version of the same graph from the same source but unfortunately in German. Maybe we could translate it. What do you think about this one? Splette :) How's my driving? 19:07, 4 November 2008 (UTC)

- The graph on the right, Image:Hubbert_world_2004.png, is for non-OPEC countries, and their rate of conventional petroleum extraction is indeed declining now. The de:Bild:Weltölförderung.png image shows total world oil extraction. The "all liquids" curve probably includes heavy oil, natural gas liquids, and biofuels. There is also the issue of continuing world population growth, between 70 and 90 million new people per year. A plateau in oil extraction really means a continuing drop in per capita production. But I agree it would be nice if someone would frequently update such graphs. If there must be future predictions, it would be best to indicate the range of predictions. As the recent oil market gyrations indicate, nobody knows exactly what the future holds. Which, incidentally, is why putting oneself in a position where one needs the best-case projection to come true is risky. --Teratornis (talk) 00:25, 5 November 2008 (UTC)

- The graph on the right is a bit outdated. It shows production only til 2003 or so. Also, what I don't like about it is the projected future because it is biased. As you see the graph projects a significant decline in production til 2010. This is not quite what we observe so far. Therefore, I'd prefer to have a graph without 'future'. Here is an updated future-free version of the same graph from the same source but unfortunately in German. Maybe we could translate it. What do you think about this one? Splette :) How's my driving? 19:07, 4 November 2008 (UTC)

- uh, the value of the graph in the url I posted isn't in the precision of numbers but the conceptual representation for grasping the concept, i.e.: "It doesn't matter if a well is opened after the peak and is going well, the overal view of the curve is still declining (at that point)" (the 'individual wells' bit). fs 21:51, 12 October 2008 (UTC)

208.85.202.34 (talk) 00:53, 9 December 2008 (UTC)The two graphs mentioned in the above paragraph without "future" are both in German and very hard to understand. Are there any in english?208.85.202.34 (talk) 00:53, 9 December 2008 (UTC)

Leonardo Maugeri

Is Leonardo Maugeri notable enough to be listed in the bibliography? He seems to have a heavy COI given that he works as a Vice President of an energy company.Scholar search with his two works listed here already removed. NJGW (talk) 18:22, 26 October 2008 (UTC)

- Also, can someone explain to me how this article is about Peak oil rather than oil depletion? It never mentions Peak oil, and is talking about the "end of the petroleum age", when peak oil would be the peak of the petroleum age. It keeps getting inserted as a ref in the "No peak oil" section[22], but as it doesn't even mention peak oil, much less that the peak won't happen, this is very confusing to me. NJGW (talk) 01:05, 27 October 2008 (UTC)

- Quotation of the maugeri Article " The current model of oil doomsters is derived from K. M. Hubbert (5). The model is conceptually simple, but based on several assumptions. The first is that the geological structure of our planet is well known and thoroughly explored... "

- Its clearly about Hubbert theory and Peak Oil, at least so far my English goes. Just try to read it again, may be u ask a third person if u have trouble with basic understanding

- Maugeris background is mentioned, same as for Dr. Rühl or Matthew Simmons.

- COI or not - does Science have a certain reputation or not? --Polentario (talk) 01:35, 27 October 2008 (UTC)

- This is looking worse and worse for Maugeri... his "proof" that "The current model of oil doomsters is derived from K. M. Hubbert" is just the fact that Hubbert wrote a paper in 1956... around here we call that wp:SYN. But anyway, one misused citation doesn't change the fact that Maugeri's article is only about oil depletion. Can you explain what you think the content of his thesis says about peak oil? By the way, you might want to read oil depletion before you answer so you are clear on the difference; people who are new to editing these two articles often think they know the difference but don't. NJGW (talk) 02:13, 27 October 2008 (UTC)

- Maugeri dismisses both (global) Peak oil (as a flawed theory) and oil depletion as doomstering. The article is available on the web and I have edited my summary.

- Compared to Dr. Rühl, Maugeri adds some historical flavour and dismisses as well the "Oil War" thesis which is more on the depletion side.

- If you assume, maugeri would be talking about a plateau you stay within the Peak Oil assumptions and in a sort of pregalileo perspective. While for Peakers the earth is fixed, maugeri and rühl see the earth as moving around the sun.

- Yergin is the one about the plateau btw.

- Basically I dont care wether to put the edits in the "critics" or "no peak" - both apply. --Polentario (talk) 06:08, 27 October 2008 (UTC)

- Can you quote the part where Maugeri is saying that oil production will either not peak or only pateau? I can't find it. All he does is repeat the misinformation which is answered quite well here... a section which points out that the average world URR hasn't changed in over 40 years. NJGW (talk) 15:34, 27 October 2008 (UTC)

- no, plateauwise thats been your misunderstanding in the comments

- Maugeri compares differnt estimates about URR in the past, ridicules Campbells past prophecies and and sees oil panicking as a bad guidance for poltics yes. About peak - he views it as a flwaed theory not able to give a adequte picture of reality

- you seem to know better and poor Maugeri is not worth while staying here, up to you. As said, where it pro peak, an article in science would be the centerpiece if attention

- However - where are prices at the moment? Physical peak oil would not allow prices going down, or why have Simmons and others predict 200$ and more per barrel --Polentario (talk) 06:25, 28 October 2008 (UTC)

- Like I said, since you're placing Maugeri in the "no peak" section, you'll have to show us where he says there will be no peak. If he doesn't then he'll be removed. As for the URR's of the past, I answered that... they've been stable for over 40 years, so there's no argument that can be made with that line of reasoning.

- As for prices, my understanding is that since demand has fallen so much in the past 12 months (it started falling over 12 months ago btw), there is too much supply. This says nothing about a peak. Some pro-peak economists actually predicted that this is exactly what would happen, and that prices would jump up and down wildly as demand and supply interact. If demand goes back up or supply dips low enough, $200 will happen. NJGW (talk) 06:33, 28 October 2008 (UTC)

- Predictions are difficult, especially if they involve the future. Simmons bet is insofar quite important - he put his moneay on 200$ 2010 and not in a unspecified future

- btw: its intersting that your last claims are completely unsourced.

- Taking physical peak oil for granted means NO flexibility in prices - atleast according Rühl

- Think maugeri is now placed more comfortable BR --Polentario (talk) 09:48, 28 October 2008 (UTC)

Some sentences in the Maugeri paragraph do not show that they are attributed to Maugeri. Either attribute them or remove them. --Skyemoor (talk) 11:25, 28 October 2008 (UTC)

World Energy Outlook 2008

Has anyone started working on integrating parts of the International Energy Agency (IEA) World Energy Outlook 2008 into this article? As the IEA press release states, this is quite a departure from previoius World Energy Outlooks.

BTW, I used to contribute to this article several years ago, back when it was "Hubbert peak theory." IMHO, the "Peak oil" article today is vastly improved. Jkintree (talk) 17:29, 22 November 2008 (UTC)

First sentence

This first sentence says it is the point in time when...It is important that to verify peak oil has occurred, oil production must cease and be studied. Otherwise, it is theoretical. Even then, it will be theoretical (Was the theoretical point in time). The point is, since the whole concept of Peak Oil is a theory (Like any scientific theories or mathematical theorems), it is THEORETICAL. It should NOT be stated as FACT in and of itself-it is THEROETICALLY BASED off assumptions which seem to be true. Do not revert without good reason, such as undeniable evidence it is NOT theoretical. And since it IS theoretical, do NOT remove.J. M. (talk) 16:43, 24 January 2009 (UTC)

- In reality, this is an "observed phenomenon", much like (the technically speaking "scientific theory" of) gravity. There is a predetermined amount of petroleum in the ground, so by definition we cannot maintain the same rate of extraction. Petroleum extracted is a Gompertz function, where the amount extracted at the beginning took a while to ramp up, then came a 'golden age' of faster and faster extraction, which must at some point slow down because of the upper limit of available petroleum. The undeniable existance of the inflection point in this graph is peak oil. The integral of the Gompertz function is Hubbert curve (which illustrates the rate of extraction rather than the amount). This has been observed in many countries (as shown in detail in the article), as well as countless individual wells. NJGW (talk) 17:57, 24 January 2009 (UTC)

- That sums it up pretty well NJGW... key phrase, 'inflection point'. It is just another aspect of the next most probable in regard to the science method mentioned http://physics.ucr.edu/~wudka/Physics7/Notes_www/node6.html - We live in a closed system... and there is only so much fossil fuel oil in the ground. skip sievert (talk) 18:15, 24 January 2009 (UTC)

Reopening "Is it really peak oil now?"